‘Job Hugging’ Holds Workers In Place As Burnout Builds Beneath Stable Turnover Rates

Key Points

Low turnover rates hide rising burnout as job hugging keeps workers in place while workloads grow and the job market cools.

Cole Napper, VP of Research, Innovation, & Talent Insights at Lightcast, explains how urgency culture, management strain, and uneven labor markets distort traditional workforce metrics.

Leaders can respond by investing in AI upskilling and management support, using tighter signals than turnover alone to guide workforce decisions.

The employee-friendly market that existed in 2021 for white-collar workers is the market that blue-collar workers are experiencing today. For them, wages and autonomy are increasing, and I would expect their eNPS scores to be increasing as well.

Cole Napper

VP of Research, Innovation, & Talent Insights

Lightcast

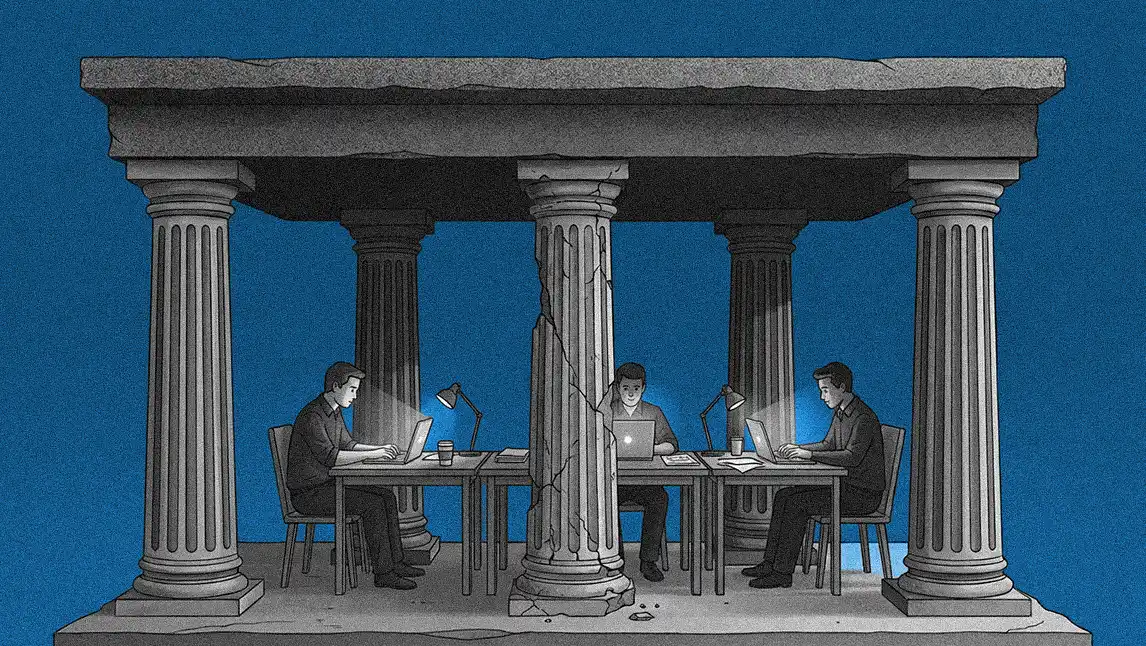

Efficiency has been the defining principle of the last two years of work. Teams are leaner, expectations are higher, and morale has thinned under the weight of doing more with less. On the surface, low turnover suggests stability. In reality, a tighter job market has left many professionals staying put not because they’re engaged, but because leaving has become riskier than staying.

We spoke with Cole Napper, a globally recognized HR leader and author of People Analytics. As the VP of Research, Innovation, & Talent Insights at labor market data provider Lightcast, Napper has guided talent strategy at major corporations like FedEx and Texas Instruments. With job openings remaining relatively flat, he says more workers today are “job hugging.” This reality doesn’t show up as apparently in the metrics, making things like low turnover rates on its own an unreliable narrator on the condition of the market.

“People are job hugging. There are not as many jobs on the market, and people are not quitting the jobs they do have. But burnout levels are increasing steadily because people are being asked to do more with less and to learn AI and new skills out of necessity,” says Napper. The data reflects this pressure, where a rise in urgency culture is contributing to an erosion of employee sentiment.

Spans and strains: The pressure is often felt most acutely at the management layer, where lack of headcount forces managers to be responsible for larger numbers of direct reports. The wider spans of control, he predicts, are poised to fuel demand for new management solutions. “Managers are going to start asking, or begging, for technology to come in and help them manage more employees at scale.”

A tale of two markets: These data points concentrate most heavily in the white-collar world. Napper points to a fundamental divergence between layoff-heavy corporate life and a blue-collar sector facing extreme labor shortages. With retiring Baby Boomers leaving blue-collar roles and an influx of Gen Z professionals competing for fewer white-collar positions, there’s been a generational inversion. “There’s a stark divergence. The employee-friendly market that existed in 2021 for white-collar workers is the market that blue-collar workers are experiencing today,” he outlines. “For them, wages and autonomy are increasing, and I would expect their eNPS scores to be increasing as well.”

Looking ahead, Napper sees two key inflection points for 2026. The first is whether over a trillion dollars in capital expenditure commitments for sectors like manufacturing, pharmaceuticals, and AI data centers will spark a year of investment. The potential for this to create new jobs, Napper cautions, is not guaranteed. Its success hinges on whether those commitments become actual projects and if interest rates remain favorable.

A fork in the road: The second inflection point is how companies manage the coming wave of AI workforce transformation. “AI workforce transformation could make work more interesting and engaging for workers, or it could make it more dehumanizing,” notes Napper.

Viewed this way, the market itself offers a clear incentive. Napper points to data showing that jobs requiring just one AI skill command an 18% wage premium on average, a figure that jumps even higher for roles requiring two or more. For many leaders, that wage premium reframes the adoption of AI as an opportunity for employee growth and skill development.

“Because it’s so expensive to hire someone with AI skills, it puts the onus on employers to start upskilling and investing in their own workers,” Napper concludes. “This is beneficial to employees on both ends of the spectrum. Whether you’re getting AI skills because your employer is investing in you, or you’re able to get more money on the job market because you have those skills, both outcomes are a win.”

Related articles

TL;DR

Low turnover rates hide rising burnout as job hugging keeps workers in place while workloads grow and the job market cools.

Cole Napper, VP of Research, Innovation, & Talent Insights at Lightcast, explains how urgency culture, management strain, and uneven labor markets distort traditional workforce metrics.

Leaders can respond by investing in AI upskilling and management support, using tighter signals than turnover alone to guide workforce decisions.

Cole Napper

Lightcast

VP of Research, Innovation, & Talent Insights

VP of Research, Innovation, & Talent Insights

Efficiency has been the defining principle of the last two years of work. Teams are leaner, expectations are higher, and morale has thinned under the weight of doing more with less. On the surface, low turnover suggests stability. In reality, a tighter job market has left many professionals staying put not because they’re engaged, but because leaving has become riskier than staying.

We spoke with Cole Napper, a globally recognized HR leader and author of People Analytics. As the VP of Research, Innovation, & Talent Insights at labor market data provider Lightcast, Napper has guided talent strategy at major corporations like FedEx and Texas Instruments. With job openings remaining relatively flat, he says more workers today are “job hugging.” This reality doesn’t show up as apparently in the metrics, making things like low turnover rates on its own an unreliable narrator on the condition of the market.

“People are job hugging. There are not as many jobs on the market, and people are not quitting the jobs they do have. But burnout levels are increasing steadily because people are being asked to do more with less and to learn AI and new skills out of necessity,” says Napper. The data reflects this pressure, where a rise in urgency culture is contributing to an erosion of employee sentiment.

Spans and strains: The pressure is often felt most acutely at the management layer, where lack of headcount forces managers to be responsible for larger numbers of direct reports. The wider spans of control, he predicts, are poised to fuel demand for new management solutions. “Managers are going to start asking, or begging, for technology to come in and help them manage more employees at scale.”

A tale of two markets: These data points concentrate most heavily in the white-collar world. Napper points to a fundamental divergence between layoff-heavy corporate life and a blue-collar sector facing extreme labor shortages. With retiring Baby Boomers leaving blue-collar roles and an influx of Gen Z professionals competing for fewer white-collar positions, there’s been a generational inversion. “There’s a stark divergence. The employee-friendly market that existed in 2021 for white-collar workers is the market that blue-collar workers are experiencing today,” he outlines. “For them, wages and autonomy are increasing, and I would expect their eNPS scores to be increasing as well.”

Looking ahead, Napper sees two key inflection points for 2026. The first is whether over a trillion dollars in capital expenditure commitments for sectors like manufacturing, pharmaceuticals, and AI data centers will spark a year of investment. The potential for this to create new jobs, Napper cautions, is not guaranteed. Its success hinges on whether those commitments become actual projects and if interest rates remain favorable.

A fork in the road: The second inflection point is how companies manage the coming wave of AI workforce transformation. “AI workforce transformation could make work more interesting and engaging for workers, or it could make it more dehumanizing,” notes Napper.

Viewed this way, the market itself offers a clear incentive. Napper points to data showing that jobs requiring just one AI skill command an 18% wage premium on average, a figure that jumps even higher for roles requiring two or more. For many leaders, that wage premium reframes the adoption of AI as an opportunity for employee growth and skill development.

“Because it’s so expensive to hire someone with AI skills, it puts the onus on employers to start upskilling and investing in their own workers,” Napper concludes. “This is beneficial to employees on both ends of the spectrum. Whether you’re getting AI skills because your employer is investing in you, or you’re able to get more money on the job market because you have those skills, both outcomes are a win.”