Context Is Key To Unlocking The Nuance Behind Virginia’s ‘Stable’ Satisfaction Score

Key Points

State-level employee engagement scores like Virginia’s can be misleading, often masking significant regional and industry-specific trends.

Laura Bowser, Managing Director and Human Capital Practice Leader at Fahrenheit Advisors, urges leaders to use qualitative follow-up to diagnose the root causes of workforce issues.

Bowser explains how to use engagement data to build a two-pronged strategy of defensive investments in key players and offensive planning for future growth.

Employee surveys are so important. You have the numbers, but then you have to sit down with people, parse out the demographics, and understand who’s actually having a good experience and why.

Laura Bowser

Managing Director & Human Capital Practice Leader

Fahrenheit Advisors

State-level employee engagement data is a key signal for workforce planning, but in a state like Virginia, a single score rarely tells the full story. A perfectly stable score in a new BambooHR eNPS report reflects an average across regions with very different economies, industries, and workforce pressures, each shaping employee experience in its own way.

Laura Bowser is the Managing Director and Human Capital Practice Leader at Fahrenheit Advisors. With a background that includes serving as CEO for an award-winning DEI firm and authoring Misfit Champions Sustainable Business Basics, Bowser has deep expertise in organizational culture and the human experience behind employee satisfaction scores. She says it’s critical that employers look past the averages to gain more meaningful context.

“Employee surveys are so important. You have the numbers, but then you have to sit down with people, parse out the demographics, and understand who’s actually having a good experience and why,” says Bowser. She believes a single number is an oversimplification, often conflating vastly different regional economies with their own workforce dynamics and cost of living.

Four states in one: Bowser highlights Virginia as an example of a place where employee experiences can vary greatly by region. “You have the high-cost, high-pressure federal contracting world in Northern Virginia, which contrasts with the booming growth in Central Virginia. Add the transient, industry-specific workforces in coastal hubs, with lots of ship repair and manufacturing, and the more rural economies in the west, and you get a blended number that masks what’s really happening on the ground.”

The industry engine: In many parts of the country, Bowser says, employee experience is heavily tied to the ups and downs of one particular industry. “Nashville, for example, has lots of healthcare,” she explains. “So if the healthcare industry is doing great, you’re going to see that impact on the score.”

When it comes to the scores themselves, she cautions employers against being overly focused on a dip or spike. Instead, she says the real danger is a flat line. “Those flat trend lines are more a sign of complacency than stability. Because of the economic uncertainty, people aren’t moving, and companies are also shifting their spending.” Bowser has observed a troubling trend in corporate spending as some companies adjust to economic pressure by pulling back on investments like executive coaching or learning and development.

Pay now or pay later: Though cutting back in these areas may solve short-term financial challenges, Bowser warns the cost will show up down the road. “The danger comes when the economy improves and opportunity returns. If you haven’t been investing in your people, everyone begins to jump at once. You lose institutional knowledge because that knowledge transfer hasn’t been happening correctly, and suddenly you’re facing millions of dollars in losses that could have been prevented with basic succession planning.”

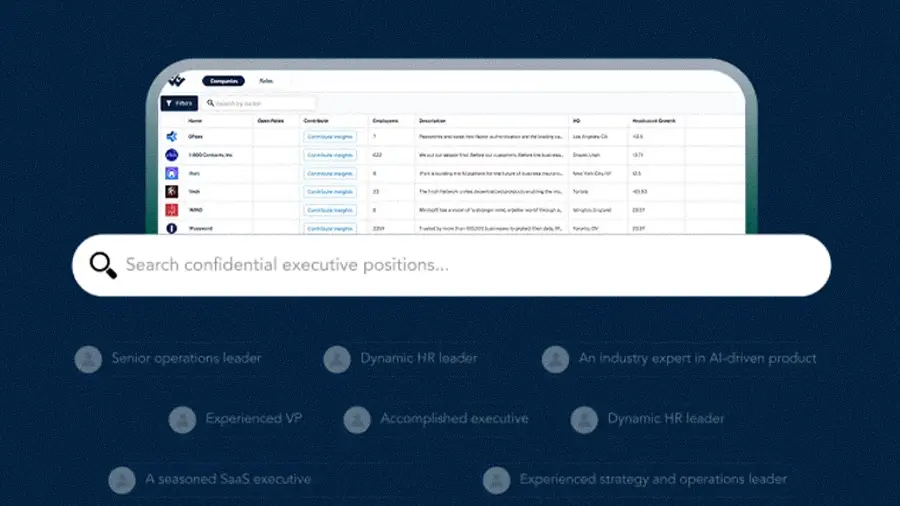

The combination of stagnant sentiment and deferred corporate investment creates a challenge that, according to Bowser, requires a clear strategic response. Her recommended approach is twofold, using engagement data for both offensive growth strategies and defensive retention tactics. “The offensive approach is to use regional scores and migration data to identify boom areas for expansion. The defensive approach is to preempt the inevitable turnover by investing in your key players now, so that when the market does start moving again, you don’t lose the talent that is critical to your success.”

The data whisperer: But even the best strategy is useless if it’s aimed at the wrong target. “Data’s strength is telling you that a problem exists,” Bowser notes. “Its limitation is that it can’t tell you why.” She points to the manufacturing industry, which has taken a big hit from tariffs. “That probably translates to employees as not getting more compensation. That impacts culture. Employees might blame management, but in reality, it’s a global trade issue.”

Bowser says engagement data does its best work when it sharpens leadership judgment rather than replacing it. Surveys, demographic cuts, and qualitative follow-ups help narrow where to look, but strategy depends on understanding which pressures a company can influence and which ones sit outside its control. That distinction allows leaders to respond with intent instead of reacting blindly to a score.

Some stressors are structural and unavoidable, she notes. The opportunity lies in how employers respond around them. “You’re not gonna be able to fix, for example, bad traffic if you live in Atlanta or Washington, D.C. But what pros can you offer?”

Related articles

TL;DR

State-level employee engagement scores like Virginia’s can be misleading, often masking significant regional and industry-specific trends.

Laura Bowser, Managing Director and Human Capital Practice Leader at Fahrenheit Advisors, urges leaders to use qualitative follow-up to diagnose the root causes of workforce issues.

Bowser explains how to use engagement data to build a two-pronged strategy of defensive investments in key players and offensive planning for future growth.

Laura Bowser

Fahrenheit Advisors

Managing Director & Human Capital Practice Leader

Managing Director & Human Capital Practice Leader

State-level employee engagement data is a key signal for workforce planning, but in a state like Virginia, a single score rarely tells the full story. A perfectly stable score in a new BambooHR eNPS report reflects an average across regions with very different economies, industries, and workforce pressures, each shaping employee experience in its own way.

Laura Bowser is the Managing Director and Human Capital Practice Leader at Fahrenheit Advisors. With a background that includes serving as CEO for an award-winning DEI firm and authoring Misfit Champions Sustainable Business Basics, Bowser has deep expertise in organizational culture and the human experience behind employee satisfaction scores. She says it’s critical that employers look past the averages to gain more meaningful context.

“Employee surveys are so important. You have the numbers, but then you have to sit down with people, parse out the demographics, and understand who’s actually having a good experience and why,” says Bowser. She believes a single number is an oversimplification, often conflating vastly different regional economies with their own workforce dynamics and cost of living.

Four states in one: Bowser highlights Virginia as an example of a place where employee experiences can vary greatly by region. “You have the high-cost, high-pressure federal contracting world in Northern Virginia, which contrasts with the booming growth in Central Virginia. Add the transient, industry-specific workforces in coastal hubs, with lots of ship repair and manufacturing, and the more rural economies in the west, and you get a blended number that masks what’s really happening on the ground.”

The industry engine: In many parts of the country, Bowser says, employee experience is heavily tied to the ups and downs of one particular industry. “Nashville, for example, has lots of healthcare,” she explains. “So if the healthcare industry is doing great, you’re going to see that impact on the score.”

When it comes to the scores themselves, she cautions employers against being overly focused on a dip or spike. Instead, she says the real danger is a flat line. “Those flat trend lines are more a sign of complacency than stability. Because of the economic uncertainty, people aren’t moving, and companies are also shifting their spending.” Bowser has observed a troubling trend in corporate spending as some companies adjust to economic pressure by pulling back on investments like executive coaching or learning and development.

Pay now or pay later: Though cutting back in these areas may solve short-term financial challenges, Bowser warns the cost will show up down the road. “The danger comes when the economy improves and opportunity returns. If you haven’t been investing in your people, everyone begins to jump at once. You lose institutional knowledge because that knowledge transfer hasn’t been happening correctly, and suddenly you’re facing millions of dollars in losses that could have been prevented with basic succession planning.”

The combination of stagnant sentiment and deferred corporate investment creates a challenge that, according to Bowser, requires a clear strategic response. Her recommended approach is twofold, using engagement data for both offensive growth strategies and defensive retention tactics. “The offensive approach is to use regional scores and migration data to identify boom areas for expansion. The defensive approach is to preempt the inevitable turnover by investing in your key players now, so that when the market does start moving again, you don’t lose the talent that is critical to your success.”

The data whisperer: But even the best strategy is useless if it’s aimed at the wrong target. “Data’s strength is telling you that a problem exists,” Bowser notes. “Its limitation is that it can’t tell you why.” She points to the manufacturing industry, which has taken a big hit from tariffs. “That probably translates to employees as not getting more compensation. That impacts culture. Employees might blame management, but in reality, it’s a global trade issue.”

Bowser says engagement data does its best work when it sharpens leadership judgment rather than replacing it. Surveys, demographic cuts, and qualitative follow-ups help narrow where to look, but strategy depends on understanding which pressures a company can influence and which ones sit outside its control. That distinction allows leaders to respond with intent instead of reacting blindly to a score.

Some stressors are structural and unavoidable, she notes. The opportunity lies in how employers respond around them. “You’re not gonna be able to fix, for example, bad traffic if you live in Atlanta or Washington, D.C. But what pros can you offer?”