Why the ‘People Ops’ vision breaks down in high stakes environments where HR has no substitute

Key Points

People Ops seeks to streamline HR processes, but compliance remains a critical focus, especially in high-risk industries.

Michael Francis of SBA Communications discusses using AI to handle compliance, freeing HR to focus on strategic roles.

AI technology can offload compliance tasks, allowing HR departments to focus on strategic initiatives.

Payroll professionals can become strategic partners by utilizing data to uncover hidden costs in business deals.

HR and People Ops are trying to do the same thing. It’s just the focus goes away from being a bureaucratic HR focus to more of a manager self-service focus. I think you can achieve that today, but you cannot take away the compliance pieces of what a traditional HR department does.

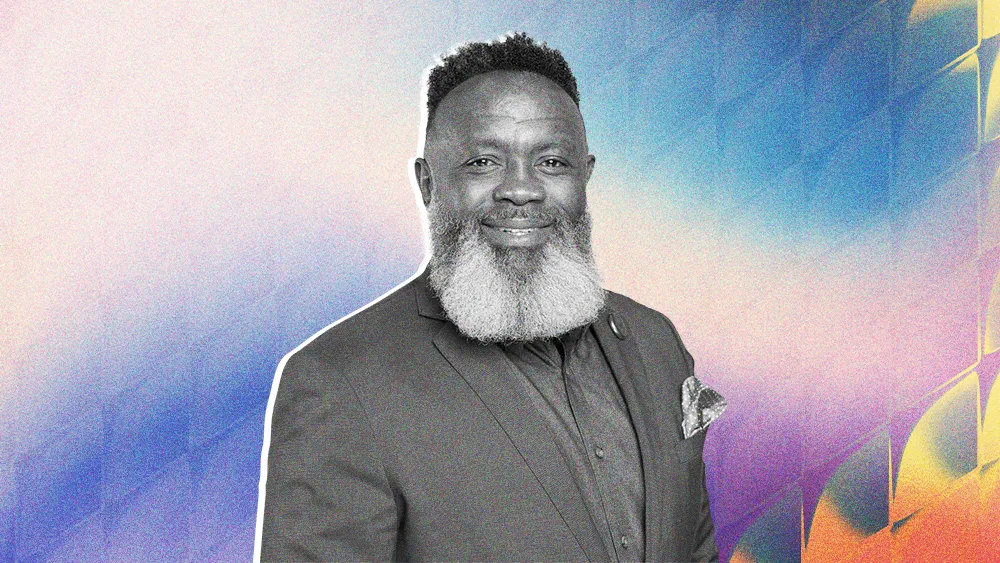

Michael Francis

Director of Global Payroll

SBA Communications

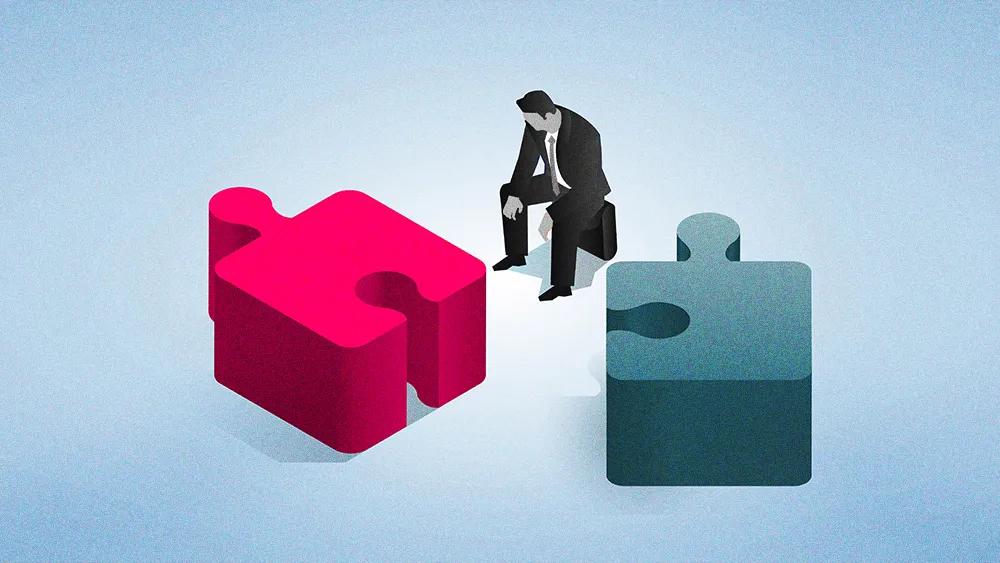

The HR world is buzzing with talk of “People Ops,” a streamlined, tech-forward model promising to empower managers and eliminate administrative drag. But for veteran leaders, the real question is how to adopt the ideal without breaking the operational realities of their business.

Michael Francis, Director of Global Payroll at SBA Communications, argues the path forward isn’t about choosing between traditional HR and modern People Ops. It’s about using technology to achieve the best of both. With a career spanning EY and Johnson & Johnson, he offers a pragmatic take on what works.

Same goal, different risks: “HR and People Ops are trying to do the same thing,” says Francis. “It’s just the focus goes away from being a bureaucratic HR focus to more of a manager self-service focus.” But while streamlining is a worthy goal, he draws a hard line at compliance. “I think you can achieve that today, but you cannot take away the compliance pieces of what a traditional HR department does.”

In high-risk industries, that line becomes even clearer. “When you have people climbing towers, do you really want a manager focused on human resources activity or on the safety of the men going up on the towers?”

Compliance, coded: Francis sees AI delivering immediate impact by offloading the heavy cognitive lift of compliance. “Let’s start talking about how we stay on top of compliance,” he says. With the ability to scan tax laws, analyze updates, and flag issues across jurisdictions, “you can really hand off a lot of that compliance piece to AI.”

Define and conquer: The shift is a business reality driven from the top down. “If your leadership has a strong belief in AI and has spent the money putting AI capabilities in place, they’re going to want to make sure that they get some kind of return on their investment,” he explains. “They may force your hand, so why not be the one who defines what that looks like in your world?”

In payroll we trust: When payroll professionals embrace this role, they are freed up to become something more valuable. “How can payroll become a strategic partner to the business instead of just keeping their heads down doing manual work?” Francis asks. The answer lies in leveraging payroll’s unique data—the intersection of people and money.

In a merger or acquisition, for example, a payroll leader can spot latent costs an M&A team might miss, like a target company’s spiked unemployment experience rate. “We’re not going to stop you from making the deal,” he says, “but we’re going to make sure when you make the deal, you understand all of the costs that are involved with it.”

We’re not going to stop you from making the deal, but we’re going to make sure when you make the deal, you understand all of the costs that are involved with it.

Michael Francis

Director of Global Payroll

SBA Communications

We’re not going to stop you from making the deal, but we’re going to make sure when you make the deal, you understand all of the costs that are involved with it.

Michael Francis

Director of Global Payroll

SBA Communications

Related articles

TL;DR

People Ops seeks to streamline HR processes, but compliance remains a critical focus, especially in high-risk industries.

Michael Francis of SBA Communications discusses using AI to handle compliance, freeing HR to focus on strategic roles.

AI technology can offload compliance tasks, allowing HR departments to focus on strategic initiatives.

Payroll professionals can become strategic partners by utilizing data to uncover hidden costs in business deals.

Michael Francis

SBA Communications

Director of Global Payroll

Director of Global Payroll

The HR world is buzzing with talk of “People Ops,” a streamlined, tech-forward model promising to empower managers and eliminate administrative drag. But for veteran leaders, the real question is how to adopt the ideal without breaking the operational realities of their business.

Michael Francis, Director of Global Payroll at SBA Communications, argues the path forward isn’t about choosing between traditional HR and modern People Ops. It’s about using technology to achieve the best of both. With a career spanning EY and Johnson & Johnson, he offers a pragmatic take on what works.

Same goal, different risks: “HR and People Ops are trying to do the same thing,” says Francis. “It’s just the focus goes away from being a bureaucratic HR focus to more of a manager self-service focus.” But while streamlining is a worthy goal, he draws a hard line at compliance. “I think you can achieve that today, but you cannot take away the compliance pieces of what a traditional HR department does.”

In high-risk industries, that line becomes even clearer. “When you have people climbing towers, do you really want a manager focused on human resources activity or on the safety of the men going up on the towers?”

Compliance, coded: Francis sees AI delivering immediate impact by offloading the heavy cognitive lift of compliance. “Let’s start talking about how we stay on top of compliance,” he says. With the ability to scan tax laws, analyze updates, and flag issues across jurisdictions, “you can really hand off a lot of that compliance piece to AI.”

Michael Francis

SBA Communications

Director of Global Payroll

Director of Global Payroll

Define and conquer: The shift is a business reality driven from the top down. “If your leadership has a strong belief in AI and has spent the money putting AI capabilities in place, they’re going to want to make sure that they get some kind of return on their investment,” he explains. “They may force your hand, so why not be the one who defines what that looks like in your world?”

In payroll we trust: When payroll professionals embrace this role, they are freed up to become something more valuable. “How can payroll become a strategic partner to the business instead of just keeping their heads down doing manual work?” Francis asks. The answer lies in leveraging payroll’s unique data—the intersection of people and money.

In a merger or acquisition, for example, a payroll leader can spot latent costs an M&A team might miss, like a target company’s spiked unemployment experience rate. “We’re not going to stop you from making the deal,” he says, “but we’re going to make sure when you make the deal, you understand all of the costs that are involved with it.”